Your credit score is a number assigned to you between 300 and 850 that credit card providers and lenders use to determine how financially trustworthy you are. Many factors affect your credit score, but unpaid debts, especially those that appear as collection accounts on your credit report, are the most influential. The average credit score for a US citizen in 2021 was 714, as reported by FICO, one of the major credit analytics companies. A score above 700 is generally regarded as “good.”

Checking your FICO score as well as reading your credit reports from the three major credit reporting agencies (CRAs)—Equifax, Experian, and TransUnion—helps you decide what to do to improve your credit score. All US citizens and permanent residents can request a free copy of their report once a year from each of the credit-reporting bureaus. By spacing your requests four months apart, you’ll get regular updates. If your score dips, look to see if any collections have appeared on your report. These are unpaid debts that the lending company has passed on to a debt collection agency. Collections can have a devastating impact on your credit score, limiting your ability to mortgage a house, finance a car, or even find a job.

What are Collections on Your Credit?

When a repayment you owe is 180 days or more past due, the company you owe the money to will close the account (this is called a “charge-off”). A charge-off indicates that the creditor or lender doesn’t believe you’ll pay and won’t waste any more time or resources chasing your debt. However, this doesn’t let you off the hook. The company will pass the debt on, either to its in-house collections department or to an outside agency specializing in debt collection.

From that moment on, all your credit reports will include a line about how much money you have in collections accounts. And, if the company you owed money to originally has sold the debt to a collection agency, there’ll be not just one but two negative items on your report: one for the charge-off and one for the collections account. This could cause your credit score to drop by 100 points or more.

You Have Negative Collection Items on Your Report—What Now?

You’re unlikely to get an account in collections removed from your credit report unless the lender has reported the unpaid debt inaccurately (an error like this could be the result of identity theft—when someone steals your account details and uses them to spend on your credit as if they were you). This is just one (very important!) reason why you should check your credit reports regularly. You can spot and contest any errors on your credit as soon as they appear. If you find mistakes, read up on how to remove negative items from credit and then take action.

With around 29% of companies checking the credit reports of potential employees, having negative items on yours could raise red flags and stop you from landing your dream job—especially if the role involves handling money. Even unpaid medical bills could count against you. There’s a widespread misconception that medical debts don’t matter as much because they’re treated differently; however, they’ll still show up as negative items on your report and will affect your FICO score if left unpaid.

Removing or Disputing a Collection

If you believe that a lender or credit provider has made a mistake in reporting you for non-payment, you can dispute the account in collections and try to have the negative item removed from your report.

We’ve broken this process down into four steps: The first is essential. The three that follow are various approaches you can take.

Verify that the negative item is inaccurate

Check your financial records and credit reports carefully. Look at the dates of all your past payments on the relevant account and figure out where the error occurred, as precisely as you can. You should also request a debt validation letter from whichever company owns the debt now, whether that’s still the original lender or a debt collection agency. A debt validation letter is a written notice that creditors and collection agencies are required by law to give you, stating how much you owe along with any other details related to the debt.

File a dispute

If you still think the negative item is an error, you can file your dispute with the relevant CRA online (via its website) but doing so makes your case harder to track. If you send your dispute by mail, on the other hand, you’ll create a useful paper trail. Make sure you keep dated copies of all the letters you send and use registered mail. You’ll find a template for a dispute letter on the Federal Trade Commission’s website. Our sample negotiation letters for goodwill deletions, debt validation, and more, will also be helpful.

Or ask for a removal

If it turns out that the collection account on your report is accurate, it’s still worth having a go at having it removed, even though your chances of success are limited. You could, for example, ask for a “goodwill deletion.” This is when the company that owns the debt (not the CRA) removes the item. Generally, a lender or creditor will do this only if you’ve settled the debt and don’t have a history of bad credit management. You can also try negotiating with debt collectors, saying that you’ll pay off the amount if they agree to delete the item (this is called a “pay-to-delete” arrangement).

But bear in mind that most collection agencies have contracts with the CRAs obliging them to report credit data accurately. If the credit bureaus see too many deletions from certain collectors, they may stop doing business with them. Because all collection agencies want to avoid this scenario, they’re likely to say no if you request a pay-to-delete deal.

Or wait it out

Although we don’t recommend not paying your debts as a strategy, it’s a fact that late repayments, also known as delinquencies, fall off your credit report after seven years. If you have more than one late payment, the seven years start from the date of the first late payment. Furthermore, even if the original lender has sold the debt to a collection agency, the seven-year period starts on the date of the first late payment, not from the date on which the agency took the debt. So, say you haven’t made a repayment that was due in April 2015 and another that was due in October 2015—the delinquency will no longer show up on your report after April 2022.

But the fact that the delinquency won’t show up after seven years doesn’t absolve you of the debt. You’ll always owe it until it’s settled. It’s just that most collection agencies will give up chasing you for payment after seven years, as they can no longer report the debt.

How Collection Accounts Hurt Your Credit Score

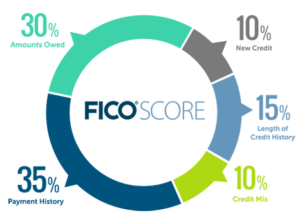

FICO scores are detailed assessments of your financial reliability. They consist of an amalgamation of several pieces of data. FICO categorizes this data into five types: amounts owed (30%), new credit (10%), length of credit history (15%), credit mix (10%), and payment history (35%).

Amounts Owed

It’s not necessarily a bad thing to be in debt if you’re keeping up with repayments. The most important thing is not to be overextended so that you can reliably meet your repayment obligations.

You should be aware of your credit utilization rate: the lower this is, the better. Your rate is the total amount of money you owe divided by your total credit limit. So, if you owe $10,000 and the credit limit of all your cards combined is $20,000, then your credit utilization rate will be 50%. Generally, it’s a good idea to keep your credit utilization rate below 30%.

New Credit

The more accounts you open in a short period of time, the riskier you’ll seem to lenders. New accounts will lower your average account age, which can damage your score. Also, when you apply for a new loan or credit account, lenders run hard inquiries on your credit report—this negatively affects your FICO score, too.

Length of Credit History

In general, the longer you’ve been using credit, the better—as long as your credit history shows prompt payments rather than delinquencies.

Credit Mix

This is a calculation based on the different types of credit you use: credit card accounts, mortgages, retail store cards, auto loans, student loans, etc. Generally, having a variety of lines of credit and keeping up repayments on all of them gives a good impression to lenders and raises your credit score.

Payment History

Your track record of repayments makes up 35% of your credit score—it’s the most important factor. Having accounts in collections will negatively affect this part of your score. The amount by which a collections account will drag your score down depends on how high your score was to begin with.

A score in the 700s will be much more negatively affected by a collections account than one in the 500s. The damage to your score also depends on which scoring model you consult—some newer scoring models don’t include collections accounts that were eventually paid off in the score calculation.

How to Bounce Back After a Collection Incident

If you’ve acquired a collections account, don’t despair! Credit recovery is still possible.

Pay Up

If you’ve checked all the relevant information and find that you can’t dispute the account, the best thing to do is pay the debt. Although this won’t help you in the short term, eventually it’ll improve your credit rating. After all, a paid account looks much better on your report than an unpaid one.

Settle the Account

If you’re struggling financially, you can contact the creditor to ask if you can settle the account. This means that the creditor accepts a smaller percentage of the payment because you pay it right away. A debt settlement can also hurt your credit score, but it’s better than having a collections account on your report.

Stay on Top of Expenses

If you have other lines of credit, make sure you don’t accrue any more missed payments. Having some positive information on your credit report will help to stabilize your score. You may wish to draw up a strict budget or set up automatic payments. You can also look into debt consolidation as an option for simplifying your accounts.

Get a Secured Credit Card

You could also open a secured credit card account—that’s a credit card that requires a deposit matching your credit limit. So, for a limit of $300, you’ll need to put down the same amount to get the card in the first place. If you don’t keep up with repayments, the credit provider will keep the $300 as collateral to cover what you owe.

Making regular credit card payments on this type of account will demonstrate your ability to change your repayment habits. Stick to using your secured card only for small purchases that are easy to repay each month. The purpose of this card is not to accrue more unpayable debt but to build a positive credit history.

One thing to look out for—some secured credit cards come with high fees that eat into your deposit. Ask the provider about this before you apply.

Monitor Your Credit Regularly

The best way to ensure your credit score climbs and stays high is to be aware of what it is and of what lenders have been reporting about your credit activity. Check your score regularly with FICO and the other credit analytics companies. Request a full credit report every four months from one of the major CRAs to view all the details.

Hire a Credit Repair Agency

Credit repair can be tricky and time-consuming to do on your own, so you might find it helpful to have an experienced professional by your side. If this is you, do your research carefully to find the best credit repair companies.

Bad Credit Loans

You can still get loans even if you have bad credit, although they’re likely to come with higher interest rates. Several companies offer secured loans (for which you have to put down collateral such as a house or car to be approved). You can also check out our picks for the best debt consolidation loans, where you amalgamate all your debts into one to make it easier to pay them off.

Final Thoughts on Collection Accounts on Your Credit

Restoring your credit score to good health after you’ve had accounts in collections requires a lot of time and effort. But with dedication and responsible management of your finances, it’s possible to rebuild credit. Our top tips for when you find yourself in a bad credit situation are:

- Pay or settle any outstanding debts that have moved to collections

- Check your credit score and read your credit reports regularly

- Keep on top of your expenses going forward

- Think about hiring the services of a reputable credit repair agency.